Free Checking Accounts for ECSFCU Members' Teens (13 to 17)

Learning how to manage money is a life skill—and we’re here to make it easy. Whether it’s saving for a first car or managing allowance, this account helps teens build good financial habits with guidance from trusted adults. Help your teen start their credit union journey and gain real-world money skills in a safe, supportive environment.

For Teens:

- FREE ATM/debit card

- Free 24/7 mobile app and online banking

- Free checks (25 pack per year)

- $10 Good Grades Reward (up to twice per year*)

For Parents:

- No minimum balance

- No monthly fees

- FREE eStatements

- Joint account access for easy oversight

Ready to Open a Teen Checking Account? It’s Simple to Start!

Apply in the Branch

Visit the branch with your parent or legal guardian** to open your account.

What to bring:

- Adult: Legal Photo ID such as Drivers License

- Teen: State ID, School ID, Drivers License, Passport, Birth Certificate, or Social Security Card

- $25 to open (or more): $20 deposit for the Checking Account, $5 for Share Savings Account***

Apply Online

The teen will be the primary applicant and the parent or legal guardian will be the joint applicant. To apply online, the teen must have a Drivers License, State ID, or Passport.

Want to Help Your Teen Learn More about Finances?

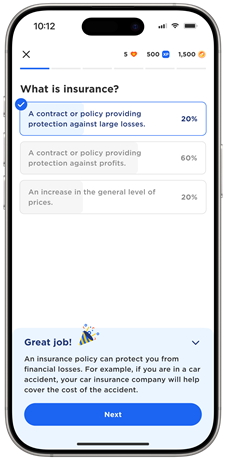

East County Schools FCU partners with Zogo, a free gamified financial literacy app for kids 13+ and adults that rewards users for completing bite-sized lessons on intelligently saving, spending, and managing their money. Earn virtual “pineapples” that can be used to redeem $5 gift cards to one of your favorite stores!

Additional Account Information

Teen Accounts are limited in usage to $300/day total in Debit Card/ATM/Point of Sale (POS) and to 8 transactions/day.

Teen Checking converts to Regular or eChecking during the month of the member's 18th birthday.

*To earn the Good Grades Reward, your report card with a minimum 3.00 grade point average must be submitted to the credit union no later than 45 days after the date of the report. Student must have a minimum of eight (8) checking account transactions during the semester, have no NSF checks or overdrawn account activity, and must be enrolled in eStatements to receive the $10 savings deposit.

**Parent or legal guardian must be an East County Schools Federal Credit Union member or be eligible to become a member.

***New checking accounts require a minimum $20 deposit and require opening a Share Savings Account with a minimum $5 deposit.