This 10-day cultural journey through Chile and Argentina blends vibrant city life, world-class wine, rich history, and the iconic traditions of South America. Experience the food, rhythm, and soul from the peaks of the Andes to the dance floors of Buenos Aires.

Triple Occupancy: $5,899 per person

Double Occupancy: $5,999 per person

Single Occupancy: $6,999 per person

Interested in this adventure? Email travel@eastcountychamber.org

🌟 Trip Highlights

Santiago, Chile: Explore colonial architecture, visit your choice of museum, and take part in a Chilean cooking class after shopping in a local market.

Mendoza Wine Country: Learn about traditional yerba mate, tour scenic vineyards, taste Malbec wines, and enjoy gourmet lunches with breathtaking Andean views.

Buenos Aires, Argentina: Dive into local neighborhoods like San Telmo and La Boca, learn about human rights history through an Impact Moment, and take a tango lesson before dancing at a local milonga.

Estancia Experience: Spend a full day in the Argentine Pampas at a traditional ranch—enjoy a gaucho-style BBQ (asado), horseback rides, and cultural performances.

Optional Day Trip: Take a ferry to Colonia del Sacramento, Uruguay, to explore its historic charm and countryside cuisine.

🧳 Good to Know

14 meals included: 8 breakfasts, 3 lunches, 3 dinners

Tour activity level: 3 (active—daily walking, uneven terrain, and high altitudes)

Max group size: 24 travelers

Roundtrip airfare from San Diego and internal flights included

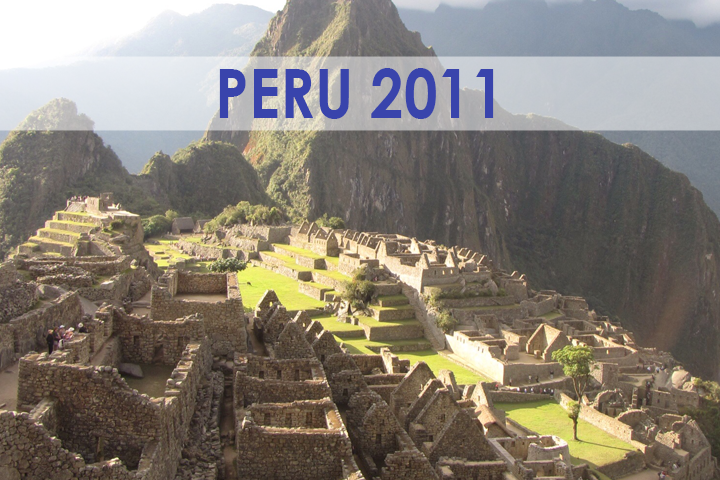

A 10-day, small-group cultural adventure through Peru’s most iconic and historic destinations—including Machu Picchu, the Sacred Valley, Lake Titicaca, and Lima—with immersive local experiences, educational visits, and luxury accommodations.

Triple Occupancy: $4,949 per person

Double Occupancy: $4,999 per person

Single Occupancy: $5,599 per person

Interested in this adventure? Email travel@eastcountychamber.org

🌟 Trip Highlights

- Lima: Explore colonial architecture, catacombs, and Peruvian cuisine.

- Sacred Valley: Visit vibrant markets, Incan ruins at Ollantaytambo, and a Quechua village for hands-on cultural activities and a home-hosted farm-to-table lunch.

- Machu Picchu: Enjoy a scenic train ride through the Andes, explore the ancient site with a guide, and stay overnight nearby.

- Cuzco: Discover the Koricancha Temple, San Pedro Market, and optional tours to Incan ruins or hidden city gems.

- Lake Titicaca: Cruise to the Uros floating islands, enjoy a home-hosted lunch, and visit ancient burial towers at Sillustani.

- Larco Museum (Lima): End your journey with a farewell dinner and access to thousands of years of Peruvian artifacts.

🧳 Good to Know

- 15 meals included (9 breakfasts, 2 lunches, 4 dinners)

- Tour activity level: 4 (active—daily walking, uneven terrain, and high altitudes)

- Max group size: 24 travelers

- Roundtrip airfare from San Diego and internal flights included

New to ECSFCU? Save $100 on Your Trip!

Open an East County Schools Federal Credit Union eChecking account earning up to 4.00% APY* with direct deposit of $500 or more by February 28, 2026 and receive a $100 credit toward your final trip payment.

East County Schools Federal Credit Union is the proud corporate sponsor of Educator Tours. Membership is open to all current and retired school employees in San Diego County, along with their family members. Learn more about eligibility here.

Travel Insurance You Can Trust

Educator Tours offers affordable, comprehensive trip insurance. In 2020 and 2021, every traveler received a 100% refund, including the cost of insurance, when trips were canceled due to COVID-19 restrictions. Our coverage allows cancellations for any reason—up to the day before departure.

Who Can Travel With Us?

Everyone is welcome! While the trips are mostly made up of the East County educational community (working and retired), and their friends and families, all tours are open to the public. The strong sense of camaraderie and fun keeps travelers coming back year after year.

Many trips include an optional educational visit, which may qualify as a work-related expense for some educators.

Questions?

Email travel@eastcountychamber.org

*APY = Annual Percentage Yield. 4.00% APY paid on the first $2,500 on deposit. 2.50% APY on balances between $2,500–$5,000. 0.25% APY on $5,000–$10,000. 0.10% APY on amounts over $10,000. Dividends calculated daily; compounded and paid monthly. Refer to our [Truth-in-Savings Disclosure] for full details. No dividends paid if monthly requirements aren't met; no penalties apply. Rates effective May 1, 2025, and subject to change. Fees may reduce earnings.

Past Tour Highlights

Check out past trip photos, highlights, and behind-the-scenes moments in our Educator Tours Facebook Group or catch a glimpse of the magic through our video recaps and photo galleries below.